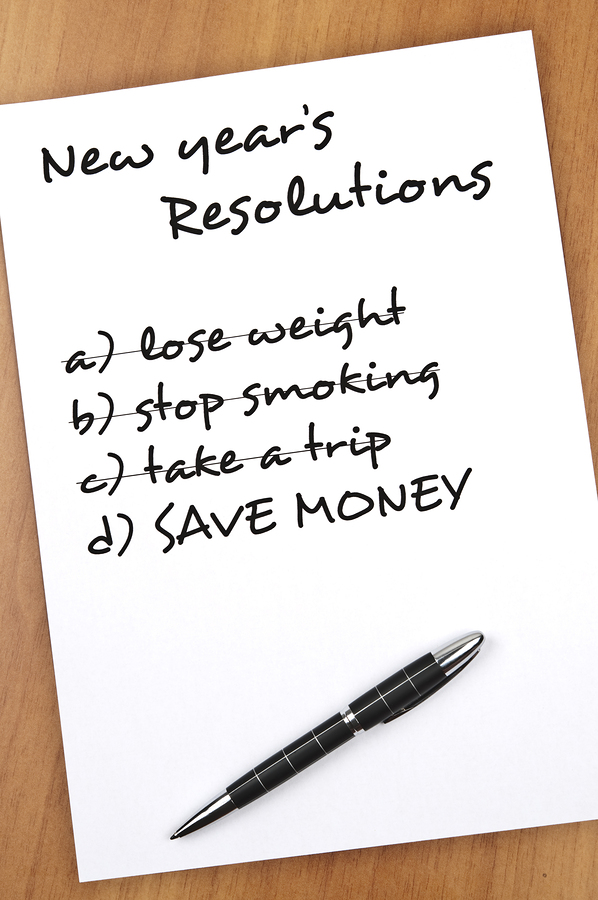

THE PERFECT NEW YEAR’S RESOLUTION: SAVE MONEY

The New Year is the perfect time to make a resolution to save money.

Follow these steps to create a lasting plan that you can stick to:

- First off, start small. Make a commitment that is manageable and realistic. A promise to contribute $100 per month to an IRA, college savings plan, or health savings account, can go a long way over time. If it’s invested well and diversified, you will reap the benefits of delayed gratification significantly. If you’re already contributing regularly, consider bumping it up a bit.

- Create a system that you can easily follow. The best way to do that is to set up an automatic savings plan. Most employers offer this option, withdrawing a specific amount from your paycheck each month to your retirement account or pension plan. Doing so enables you to “set it and forget it”. It saves time and effort and sets up good long-term habits. Several studies show that people participate in pension plans and contribute more with automatic savings plans.

- Another important step to help you save more in the coming year is to open a college savings account. A 529 plan enables you to save now for future tuition expenses. It’s important to examine the different plans offered by your state, and others, before choosing one as some differ significantly. Once you choose one, opt-in for monthly automatic contributions too. It will help you stick to your plan, with even a small commitment adding up quickly. College savings plans also make great holiday gifts for children and grandchildren, teaching them to save early and showing them that their futures matter.

- If you have a medical insurance policy with a high deductible, you probably also have a health savings account (HSA) to supplement it. Consider increasing your contribution to your HSA now while you are healthy. Your contributions are always tax-deductible, and any growth on your investment is tax-free. If you need to withdraw funds for medical expenses, they too are not taxable. In the meantime, your savings will enhance your retirement when healthcare costs tend to rise.

- Get financially educated. Learn about interest rates, inflation and asset allocation. Explore different types of investments and become familiar with concepts such as diversification and portfolio rebalancing. It may seem overwhelming, but even a simple grasp of basic investment concepts will help you make smarter decisions for your financial future.

- Also, talk to a professional financial planner about setting up an investment strategy, creating a budget and determining your goals. Remember to ask about how to track your progress and your options for minimizing risk while maximizing reward. Do not feel pressured to buy a particular policy, such as a life insurance plan, or to make any hasty decisions. A professional will help you understand your options without pushing you to spend unnecessarily.

At Silverman Financial, our goal is to help you achieve lasting financial security. Whether your goals are to save up for a house, for your children’s education, for your retirement, or for all three, we create financial solutions that work for you.

SCHEDULE A FREE CONSULTATION TODAY